What is Forex Trading and How Does it Work?

Forex trading is simply the buying and selling of currency on the foreign exchange market. Forex is a derivation of Foreign Exchange. The forex market comprises a vast network of institutions, brokers, individual traders, and bankers who trade national currencies. In a typical day, the forex market witnesses trillions of dollars exchange hands. Given its high transactional nature, it is regarded as the most liquid market in the world.

The network of buyers and sellers transfer currency to one another at an agreed price. This is necessary because to facilitate other exchanges in different other markets like the commodities market, people require local currency. In a case where one has to make a purchase in a different country or travel for that matter, they require to convert their local currency to the currency of their destination.

Banks, individuals, and companies use the forex market to facilitate this. However, while the exchanges help facilitate different purchases, the players in the market who engage this for profit are referred to as forex traders. In other words, they help facilitate the exchange of one currency to the other for the purpose of making a gain from the trade.

How does the market function?

Unlike other markets, the forex market does not involve traditional exchanges. Forex trading simply occurs directly between two parties. The market includes a global network of banks that is expanded across four forex trading centers in different time zones, namely London, New York, Sydney, and Tokyo. The lack of a central location allows traders to exchange currency 24 hours a day from Monday to Friday, except on some holidays.

How does forex trading Work?

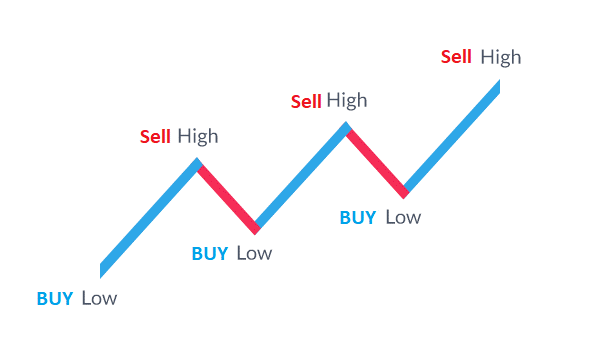

While there are several ways of trading forex, they all involve the basic buying and selling of currency. Before it moved online, this used to happen through forex brokers who had access to the market. Today, you can track price movements through numerous trading platforms online. This allows for more quick access to the market for anyone looking to trade.

Classifications of the forex market

There are three types of forex markets explained further below:

- Spot forex market: The trade-in at this market takes place “on the spot.” As the name suggests, the currency can be exchanged physically at the exact point just when the trade is settled or within a short period.

- Forward forex market: This market allows traders to buy or sell a specific amount of currency at a mutually agreed price to be settled on the specified date shortly.

- Future forex market: This market lets traders buy or sell the currency at an agreed price on a specified date in future. However, a contract in the future forex market is legally binding.

What influences the forex market?

The forex market comprises of currencies from all over the world. This makes it difficult to predict the exchange rate as the market is extremely volatile due to certain factors:

Central banks: They control the supply, and any measures announced by them can impact the currency’s price.

News reports: Media has a powerful impact on every aspect of investment. A good news piece can encourage investors from a specific region, resulting in the increasing demand for that region’s currency.

Market sentiment: It follows the news and influences traders accordingly, resulting in an increase or decrease in the demand.

Economic data: It gives an insight into the currency’s performance and can help predict the central bank’s moves.

Credit ratings: To maximize return and minimize the risk factor, investors always look for the country’s credit ratings before investing.

In parting…

Forex trading is a great way of investing your savings to generate more money. While it is not as easy as it sounds, it is a skill that can be honed overtime, translating to enviable results. It is a game of discipline and patience, and definitely not for the fainthearted. Here at Investors Hacks, we have a dedicated forum to train guys on how to do it as well as advance their existing skills. Join the forum here.

Photo by Chris Liverani on Unsplash